Taxes on 1600 paycheck

Your average tax rate is. Use this tool to.

Playing The Percentages How Much Should I Save From Every Paycheck Howstuffworks

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and.

. Add one to the percentage. Calculating your Maryland state income tax is similar to the steps we listed on our Federal paycheck calculator. Now find the tax value by multiplying tax rate by the before tax price.

Some states follow the federal tax. A tax of 7 percent was added to the product to make it equal to 1712. New York Paycheck Quick Facts.

That means that your net pay will be 37957 per year or 3163 per month. Estimate your federal income tax withholding. However making pre-tax contributions will also decrease the amount of your pay that is subject to income tax.

The money also grows tax-free so that you only pay income tax when you. The income tax rate ranges from 475 to 99. Divide the tax rate by 100.

- 000 Income Tax. Texas state income tax. - 000 National Insurance.

Tax 1600 0075. So the tax year 2022 will start from July 01 2021 to June 30 2022. The Federal Income Tax calculation includes Standard deductions and Personal Income Tax Rates and Thresholds as.

It can also be used to help fill steps 3 and 4 of a W-4 form. The table below details how Federal Income Tax is calculated in 2022. How to calculate Federal Tax based on your Monthly Income.

How to calculate Federal Tax based on your Weekly Income. No state-level payroll tax. Census Bureau Number of cities that have local income taxes.

New York income tax rate. The median household income is 60212 2017. Texas tax year starts from July 01 the year before to June 30 the current year.

1600 after tax is 1600 NET salary annually based on 2022 tax year calculation. Employer Superanuation for 2022 is payable on all employee earning whose monthly income. Able to claim exemptions.

Census Bureau Number of cities that have local income taxes. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and. How Your Texas Paycheck Works.

How Your Washington Paycheck Works. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Tax 120 tax value rouded to 2 decimals Add tax to the before tax price to get the final price.

The changes applied to individuals and. Texas income tax rate. Your hourly wage or.

1 007 107. So the tax year 2021 will start from July 01 2020 to June 30 2021. See how your refund take-home pay or tax due are affected by withholding amount.

Washington income tax rate. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Census Bureau Number of cities that have local income taxes.

The American Rescue Plan excluded up to 10200 in 2020 unemployment compensation from taxable income calculations. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. So divide 7 by 100 to get 007.

The state tax year is also 12 months but it differs from state to state. Australia Salary Tax Calculation - Tax Year 2022 - 160000 Annual Salary.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Aim How Can We Understand How Gross Income Becomes Net Income By Analyzing Our Paycheck Deductions Do Now Name And Describe The Three Ways An Employer Ppt Download

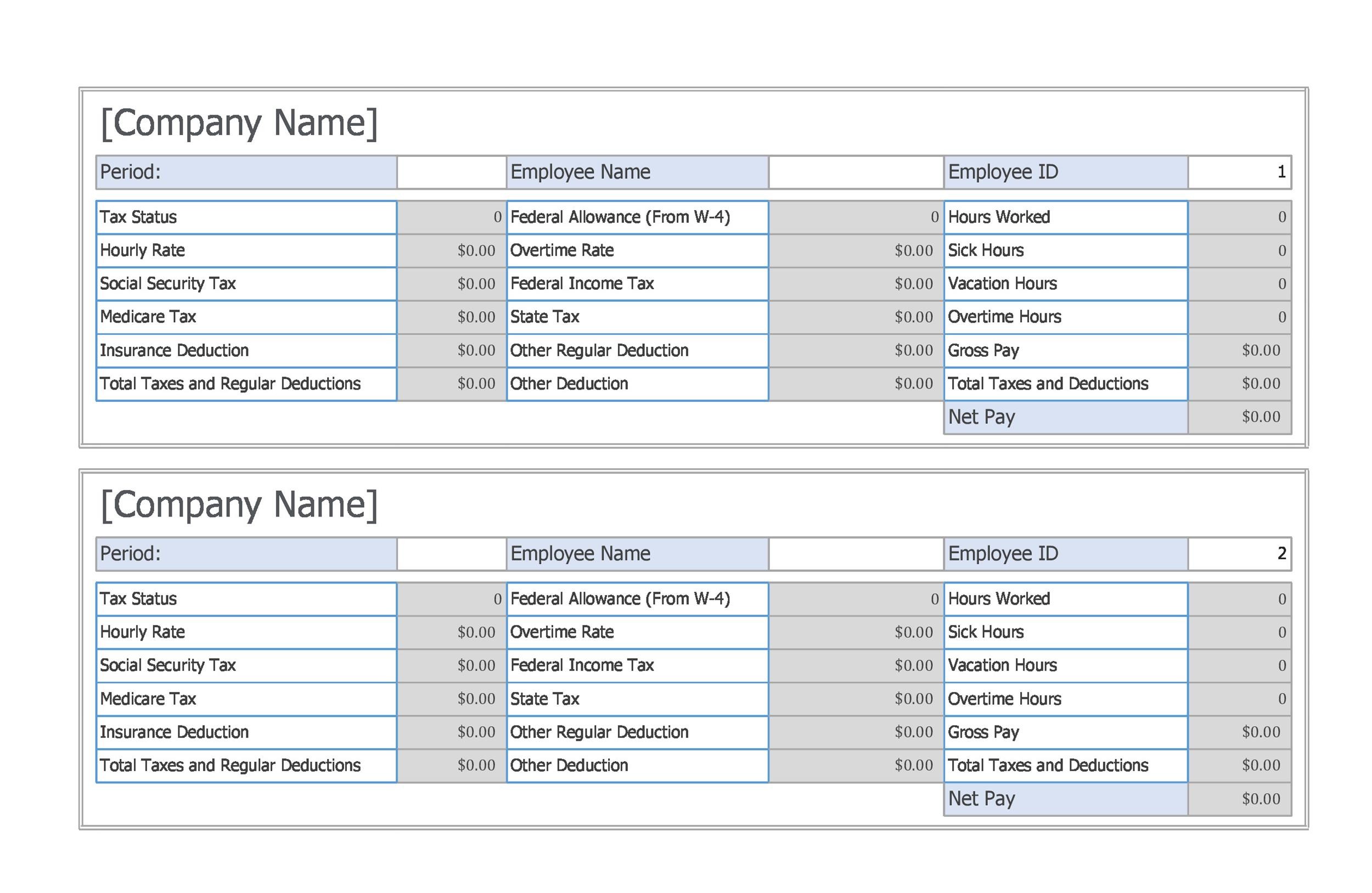

25 Great Pay Stub Paycheck Stub Templates

Paychecks Hyogo Ajet

How To Calculate Net Pay Step By Step Example

1 15 5 G1 Gross Income Vs Net Incomeevan Earns 1600 00 Personal Financial Literacy Financial Literacy Income

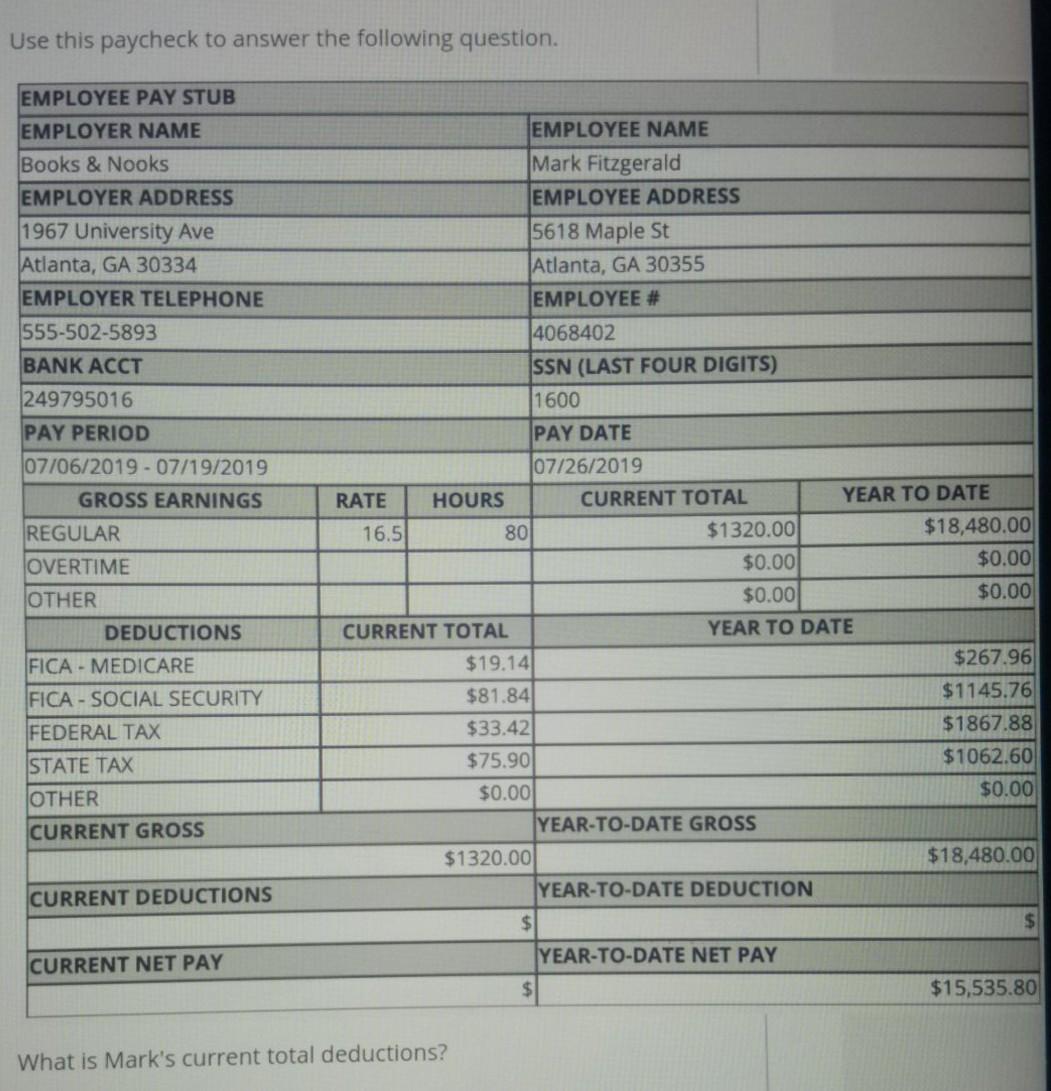

Solved Use This Paycheck To Answer The Following Question Chegg Com

How To Calculate Payroll Taxes Methods Examples More

Payroll Checks Business Checks Payroll

I Make 800 A Week How Much Will That Be After Taxes Quora

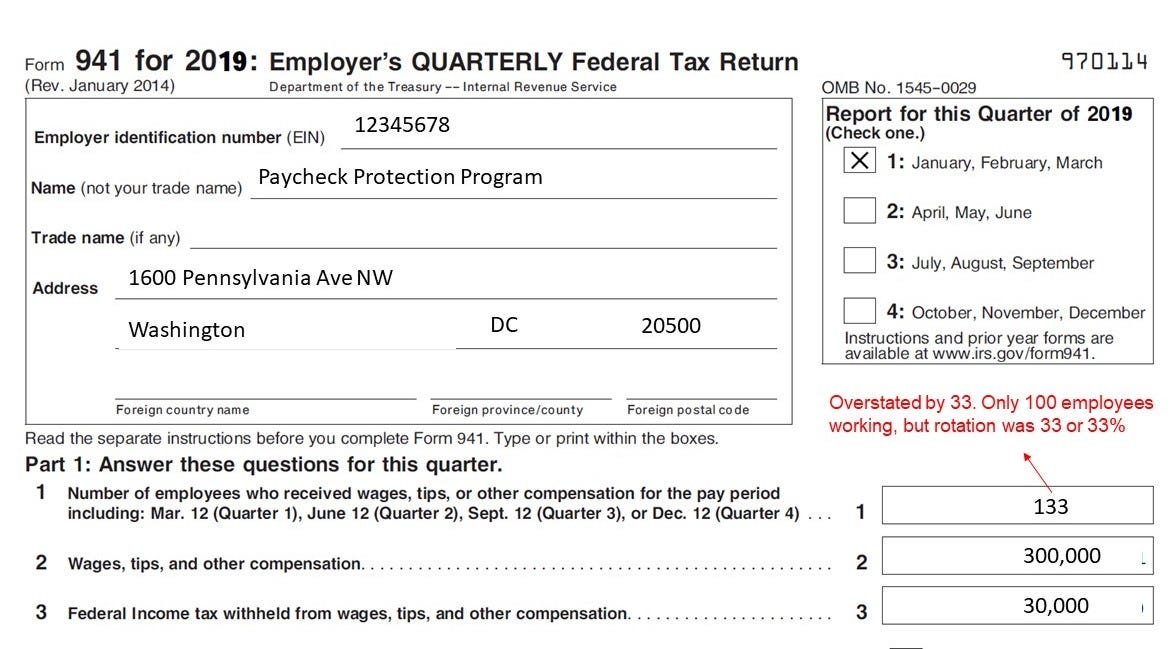

How To Calculate The Number Of Full Time Equivalent Employees Ftees By George Benaroya Medium

Irs Defers Employee Payroll Taxes Jones Day

25 Great Pay Stub Paycheck Stub Templates

Paycheck Stub Diagram Quizlet

My First Paycheck Wtf R Amazondspdrivers

How To Calculate Payroll Taxes Methods Examples More

63 Of Americans Have Been Living Paycheck To Paycheck Since Covid Hit